An evaluation of the stability implications of the bail-in design

suggests the answer is no (unless there are significant improvements in that design)

The Great Financial Crisis (GFC) crisis forced governments to choose between the unattractive alternatives of either bailing out a systemically important bank (SIB) or allowing it to fail disruptively. Bail-in has been put forward as an alternative that potentially addresses the too-big-to-fail and contagion risk problems simultaneously. Though its efficacy has been demonstrated for smaller idiosyncratic SIB failures, its ability to maintain stability in cases of large SIB failures and system-wide crises remains untested.

It is therefore critical to evaluate the financial stability implications of the bail-in design, and address any shortcomings in that design, before another severe financial crisis takes hold. While a qualitative literature exists that critically evaluates aspects of the bail-in design, to the best of our knowledge no papers have been published yet that quantitatively assess the systemic implications of the bail-in design. In our paper, (CEPR DP 16509), we aim to fill that gap. Our main contribution is to assess the financial-stability implications of the bail-in design, explicitly accounting for the multi-layered networked nature of the financial system. More broadly, our paper adds to the literature on the too-big-to-fail problem and how to resolve it.

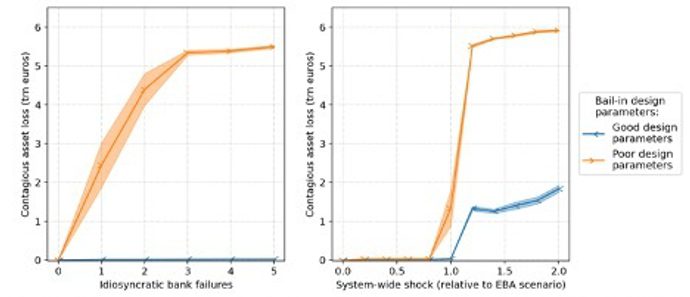

Our findings indicate that the too-big-to-fail problem remains essentially unresolved at present. Our results suggest that bail-ins under their current design are not a credible alternative to a bail-outs in severe financial crises, such as that experienced in the GFC, or in cases of idiosyncratic failures of the largest SIBs (see Figure 3, orange lines). The orange lines show that “poorly” designed bail-ins could exacerbate financial distress by increasing contagious asset losses by multiple trillions of euros. On the positive side, our results also suggest that a possible shift towards financial stability remains in the hands of policymakers – even in systemic crises – if bail-in design parameters are changed from their “poor” to “good” values (see Figure 3, blue lines). But we fear that political economy incentives make this unlikely.